Lightstone is one of the most diversified privately held real estate companies in the United States. Lightstone has a long term financial commitment to Converge RE and views the life and annuity reinsurance as a diversification of its core real estate business; an opportunity to bring proven real estate investment management expertise to enhance yields on asset portfolios supporting long duration liabilities.

Converge RE II

DISCIPLINED • EXPERIENCED • TRUSTED

About us

Converge RE manages over $1.7 billion of ceded reserves, providing reinsurance solutions to life and annuity insurance companies to help enhance their financial performance and capital efficiency.

Converge RE combines life and annuity reinsurance with a sophisticated investment strategy built on Lightstone's superior real estate investing and asset management skills, balanced by a fixed income portfolio managed by Western Asset Management – a global asset manager with over $450 billion of AUM.

Converge RE prides itself on tackling complex reinsurance opportunities and delivering creative client-oriented reinsurance solutions while adhering to stringent regulatory and insurer guidelines.

Converge RE Converge RE is managed by an experienced reinsurance and insurance team that has a track record of solid risk management and producing long-term results.

Converge RE is backed by Lightstone, which is owned and controlled by David Lichtenstein. Lightstone has provided Converge RE with $115 million of contributed capital and an additional capital commitment of $250 million to support future growth.

Converge RE is rated A- with KBRA.

Converge RE is domiciled in Puerto Rico as a Class 5 reinsurer in good standing through the International Insurance Center and is a founding member of the Puerto Rico International Insurance Associations.

Converge RE is a 953(d) US taxpayer and is subject to US laws and courts.

Product Solutions

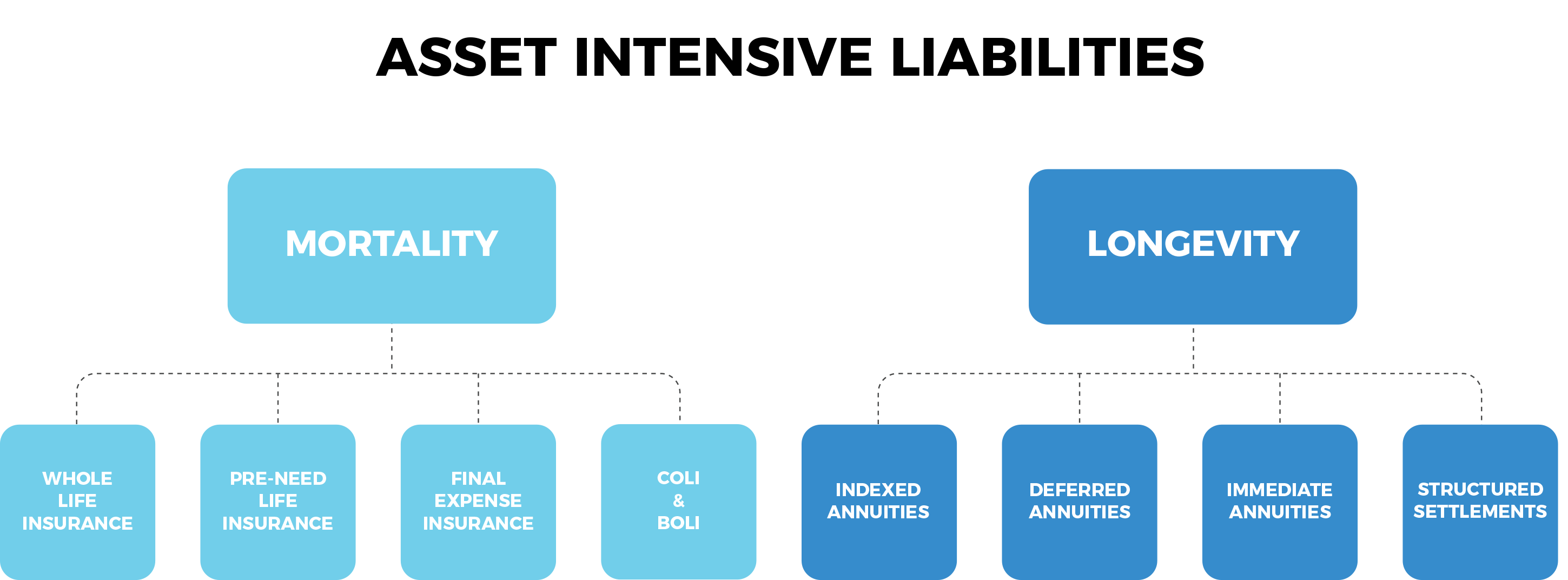

Converge RE focuses on long-tailed risks with low volatility and predictable cash flows.

OverviewLightstone

Commitment

Converge RE is committed to measured growth through underwriting excellence and investment discipline.

Converge RE is dedicated to being a transparent and long-term partner to all its stakeholders.

Lightstone is committed to the continued growth of Converge RE. The life and annuity reinsurance business is an effective diversification to Lightstone's core real estate business.

DISCIPLINED • EXPERIENCED • TRUSTED

Leadership

Craig Buck

Chief Executive Officer, Converge US

Craig Buck is the Chief Executive Officer of Converge US and is responsible for overseeing the entire operation of Converge’s life and annuity reinsurance platform.

Mr. Buck joined Lightstone in 2024, after previously serving as the Managing Principal of the Insurance and Actuarial Advisory Services practice of Ernst & Young LLP’s Financial Services Organization. Before joining Ernst & Young LLP, he held a number of leadership roles at a major international insurance and retirement company and was the Americas Life Insurance Practice Leader and the North American Actuarial Practice Leader of Towers Watson, Inc. and Watson Wyatt Insurance & Financial Services, Inc. respectively.

Mr. Buck is a Fellow of the Society of Actuaries and a Member of the American Academy of Actuaries.

Moshe Lichtenstein

Chief Investment Officer, Converge US

Moshe Lichtenstein is Chief Investment Officer of Converge Asset Management and a senior member of the Lightstone investment team. Mr. Lichtenstein is responsible for investment strategy and oversees the sub-managers for Converge Asset Management to ensure the investment portfolio complies with the Converge investment and ALM guidelines.

Erin Anders

Head of Business Development, Converge US

Erin Anders is Head of Business Development for Converge US and is responsible for leading the firms overarching business development strategy. He has held numerous leadership roles in life insurance and reinsurance spanning almost 3 decades.

David Lichtenstein

Chairman and CEO, Lightstone

David Lichtenstein is Chairman and CEO of Lightstone, which he founded in 1988. In addition to chairing the Board of Directors, he provides strategic oversight for all aspects of the acquisition, financing, and management of the Company's diverse portfolio of multifamily, hospitality, industrial and commercial properties.

Mitchell C. Hochberg

President, Lightstone

Mitchell C. Hochberg is President of Lightstone and Chairman of the Board of Directors of Converge RE II. He has more than 30 years of experience in every facet of real estate development and operations, including the residential, hospitality, commercial, gaming, and mixed-use sectors.

Dariush Akhtari

Chief Actuary, Converge US

Dariush Akhtari is Chief Actuary of Converge US, responsible for overseeing all actuarial and risk functions of Lightstone’s life and annuity reinsurance company.

Mr. Akhtari is a Fellow of both the Society of Actuaries and the Canadian Institute of Actuaries in addition to being a Member of the American Academy of Actuaries.

Naftalee Zomberg

Chief Financial Officer, Converge US

Naftalee Zomberg is the Chief Financial Officer of Converge US. Naftalee is responsible for key financial and reporting matters, including structuring and financing transactions, integrating new relationships and systems, and developing business processes across the organization.

Seth D. Molod

Executive Vice President & Chief Financial Officer

Seth D. Molod is Executive Vice President and Chief Financial Officer of Lightstone, where he is responsible for overseeing and managing all corporate finance operations. Mr. Molod brings over 25 years of extensive experience advising some of the nation’s most prominent real estate owners, developers, managers, and investors in both commercial and residential projects.

Joseph E. Teichman

Executive Vice President & General Counsel

Joseph E. Teichman is Executive Vice President and General Counsel at Lightstone, where he is responsible for overseeing and managing the legal affairs of the company and its operating entities. Mr. Teichman also contributes to the company’s overall strategy as a member of the company’s executive management team.